Table Of Content

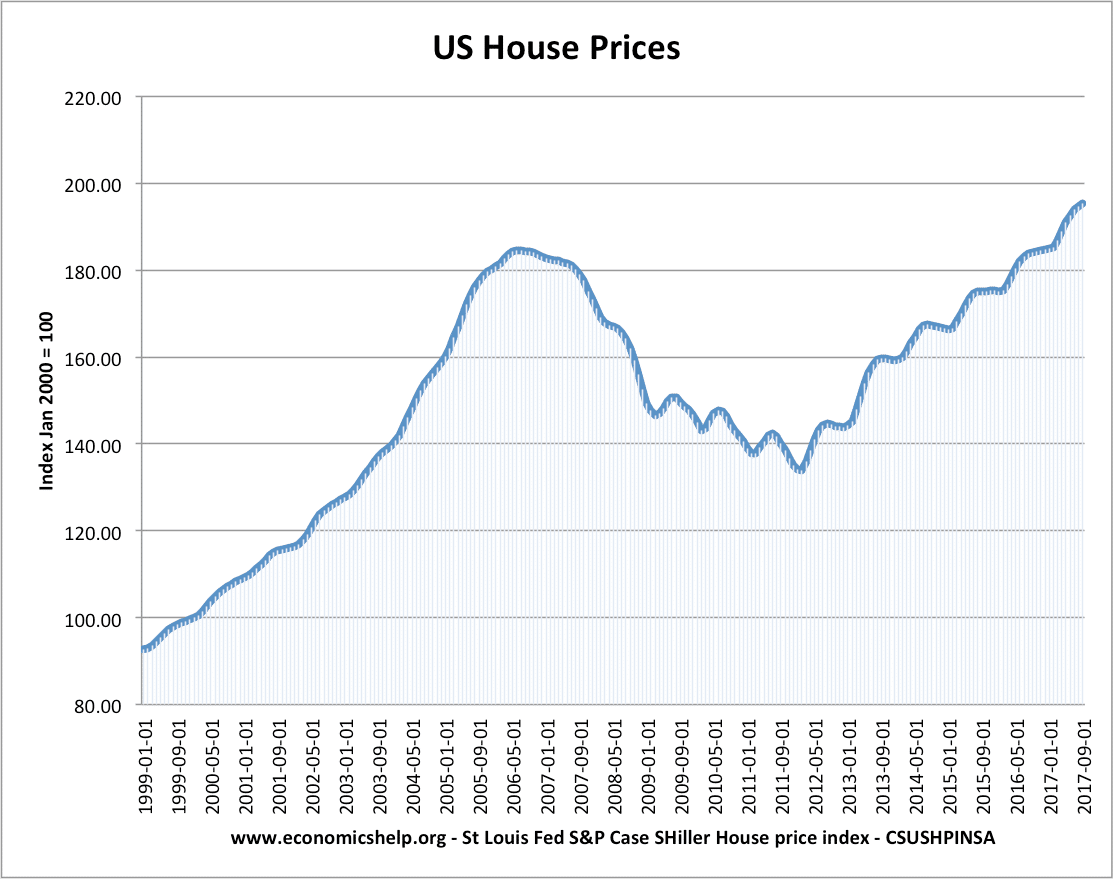

Typically, it takes about 2 months for S&P to publish the results, as opposed to 1 month for most other monthly indices and indicators. In addition, specific indexes are available for specific metropolitan areas and composite indexes for the top 20 and 10 metro areas nationwide. You can generate annual numbers by taking the four quarter average for each year or monthly numbers by finding the difference between two months. The San Francisco Federal reserve borrowed an approach from finance literature. The finance paradigm holds that an asset has a fundamental value that equals the sum of its future payoffs, each discounted back to the present by investors using rates that reflect their preferences. For stocks, the payoffs requiring discounting are the expected dividends.

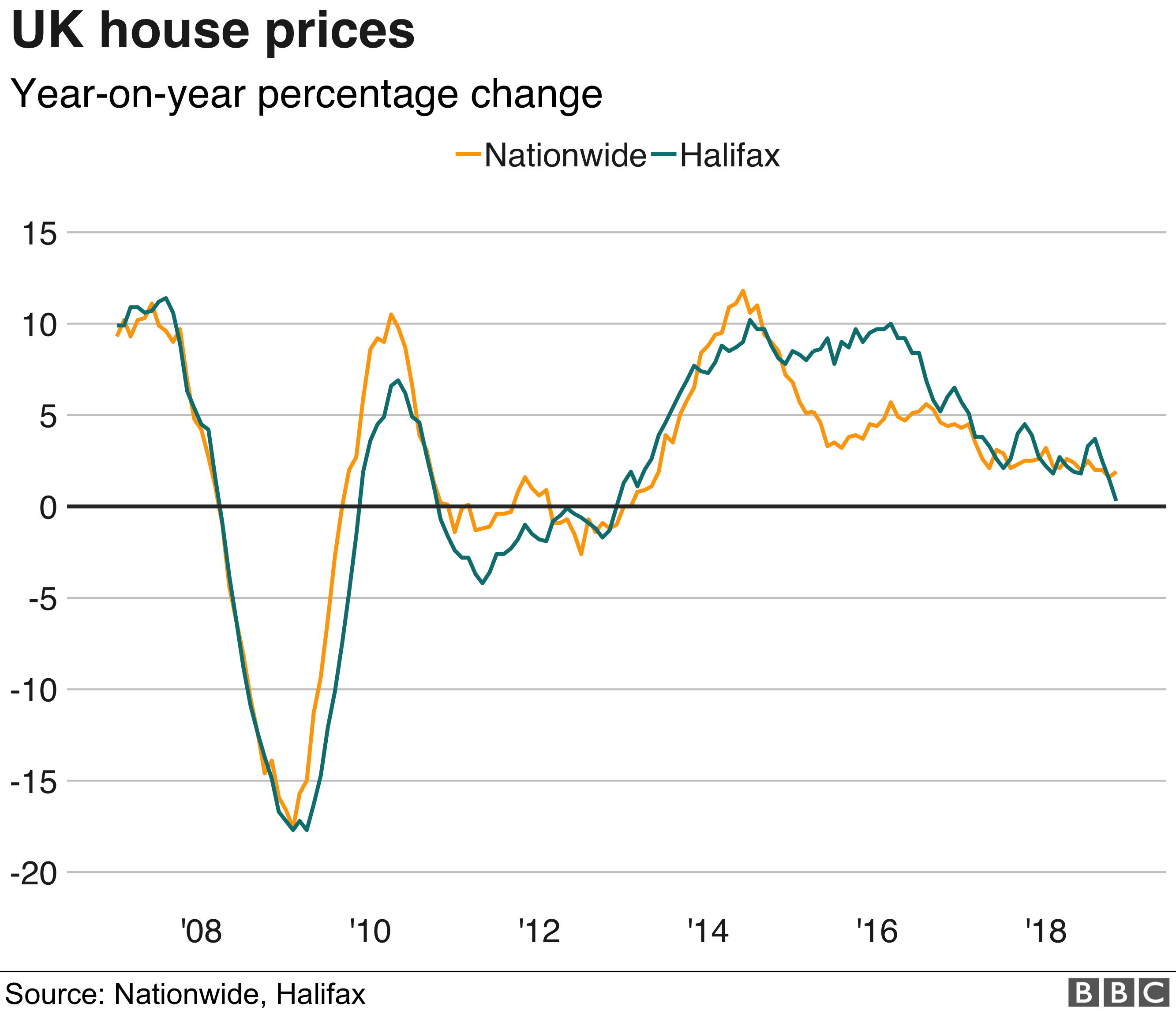

Figure 1: UK rents inflation is rising to record-highs, while UK house price annual inflation remains negative

Data is available at the national, regional, divisional, state, metropolitan, metropolitan division, county and ZIP code levels. For the nine census divisions, seasonally adjusted monthly house price changes from October to November 2022 ranged from -1.1 percent in the Pacific division to +0.5 percent in the WestNorth Central division. The 12-month changes were all positive, ranging from +2.4 percent in the Pacific division to +12.0 percent in the South Atlantic division. The HPI is a weighted, repeat-sales index that measures average price changes in repeat sales or refinancings on the same properties in 363 metropolises. The FHFA’s House Price Index is calculated using a weighted repeat-sales method.

FHFA/OFHEO

Aside from serving as an indicator of house price trends, it also functions as an analytical tool for estimating changes in the rates of mortgage defaults, prepayments, and housing affordability. Purchase-Only Indexes Volatility ParametersThe standard deviation of house price growth (accounting for the time between repeat sales). Use prices from sales transactions of mortgage data obtained from the Enterprises.

Monthly Data

In March 2024, the average monthly private rent was highest in London (£2,055) and lowest in the North East (£662). In their March 2024 UK Residential Market Survey, the Royal Institution of Chartered Surveyors (RICS) reported rising tenant demand and, for the 20th consecutive month, declining volume of new landlord instructions. Because of this imbalance, their respondents continue to expect rents to rise over the coming months.

Home prices hit a new all-time high in December, Case-Shiller says - MarketWatch

Home prices hit a new all-time high in December, Case-Shiller says.

Posted: Tue, 27 Feb 2024 08:00:00 GMT [source]

RELEASE TABLES

This will reduce with subsequent revisions, however data on loans purchased with a longer lag, including seasoned loans, will continue to generate revisions, especially for the most recent quarters. We similarly estimate the following concepts for those 11 areas, as an average of the FHFA-reported index in each metro division, weighted by housing stock. That is, if MSA G has an index reported for component metro divisions G_1..G_n, for each metro division G_i the weight is (FHSTKQ.G_i / sum i..n over FHSTKQ.G_i). As of April 2023 we corrected this method to include only component divisions for which an index is reported. The House Price Index helps first-time buyers gain insight into the trends and direction of the national housing market, which can help a buyer make informed decisions about when and where to purchase a property. Many factors bring down the value of a house, such as any new planned construction in the area that would be seen as less than desirable, such as a highway.

Redfin Home Price Index: Price Growth Slowed for Third Straight Month in November as Supply Crunch Eased - Redfin News

Redfin Home Price Index: Price Growth Slowed for Third Straight Month in November as Supply Crunch Eased.

Posted: Tue, 19 Dec 2023 08:00:00 GMT [source]

By chain-linking the IPHRP (pre-2015) and PIPR (2015 onward) indices together, we have published a full historical series for the UK, Great Britain, its countries and English regions. Series begin in January 2005 for England, January 2009 for Wales, January 2011 for Scotland, and January 2015 for Northern Ireland and the UK. We advise caution when comparing pre-2015 trends with later estimates because of the methodology change in January 2015. Average private rent for England was £1,285 in March 2024, up 9.1% (£107) from a year earlier.

Private rent and house price inflation

This paves the way for greater aggregate demand, boosting gross domestic product (GDP) and overall economic growth. The amount of time between the sale of a property and the registration of this information varies. Volume figures for the most recent 2 months are not yet at a reliable level for reporting, so they are not included in the report. Published transactions for recent months will increase as later registered transactions are incorporated into the index. The Price Index of Private Rents (PIPR) reflects price changes for all privately-rented properties (including for existing tenancies), not only changes for newly-advertised lets. Annually, over 450,000 private rent prices are collected in England and around 30,000 in Wales, 40,000 in Scotland, and 15,000 in Northern Ireland.

Annual Report to Congress

Similar to the “four-quarter” price changes, the “one-quarter” percentage change estimates the percentage change in home values relative to the prior quarter. Please note that, in estimating the quarterly price index, all observations within a given quarter are pooled together; no distinction is made between transactions occurring in different months. As such, the “four-quarter” and “one-quarter” changes compare typical values throughout a quarter against valuations during a prior quarter. The appreciation rates do not compare values at the end of a quarter against values at the end of a prior quarter. The house-price index is a weighted repeat sales index, meaning that it measures average price changes in repeat sales or refinancing's on single-family properties. The mortgages measured by the house price index are both conforming and conventional.

The House Price Index (HPI) is an economic indicator that tracks changes in home prices across the United States, based on purchases of the same home over time. While the Case-Shiller indexes only use purchase prices, the all-transactions HPI includes refinancing appraisals as well. The U.S. CoreLogic S&P Case-Shiller index rose by 6% in January 2024 from January 2023. Quarterly All-Transactions Indexes Build on the purchase-only index data by adding prices from appraisal data obtained from the Enterprises.

Some of the most well-known alternatives are the S&P CoreLogic Case-Shiller Home Price indexes. For all other Metropolitan Statistical Areas and Divisions the FHFA All-Transactions Index is used. For a list of the largest 100 Metropolitan Statistical Areas and Divisions, click here. For a discussion of the differences between the Purchase-Only Index and the All-Transactions Index, click here.

The “four-quarter” percentage change in home values is simply the price change relative to the same quarter one year earlier. For example, if the HPI release is for the second quarter, then the “four-quarter” price change reports the percentage change in values relative to the second quarter of the prior year. It reflects the best estimate for how much the value of a typical property increased over the four-quarter period (FAQ #2 reports the types of properties included in this estimate). “One-year” and “annual” appreciation are used synonymously with “four-quarter” appreciation in the full quarterly HPI releases.

No comments:

Post a Comment